19th May 2021

When we appraise investment in public projects, discounting is the approach used to put future costs and benefits, in present economic values.

Discounting is particularly important for public projects for transition -to reduce emissions and improve the environment- and to adapt to the growing impacts of climate change. This is because the financial investments in such projects are up-front, while the costs and benefits materialise in the long-term. Setting discount rates too high means that socially undesirable projects may proceed, and long-term beneficial projects may be scuppered.

Ireland has had a practice of lumping all costs and benefits under a single rate, applying an excessively high rate and also of using short time horizons for analysis of projects (O’Mahony 2021). All of these practices are inconsistent with low-carbon transition and sustainable development. Updating these practices is necessary if we are to address the challenges we now face, including programme for government commitment to deeply reduce emissions by 2030, and commitments to adapt to climate change.

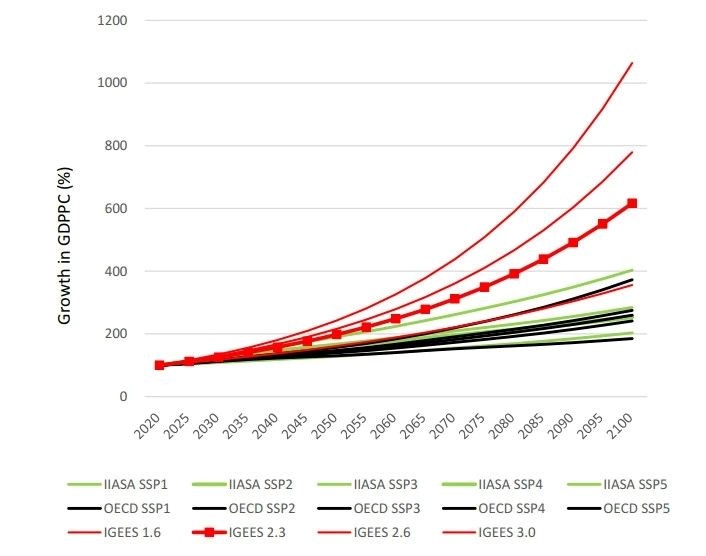

Ireland applies a high discount rate for a wealthy nation at 4%. This discount rate will undermine the value of public investments in transition and adaptation in Ireland, and needs to be brought into line with standard practices internationally. A new study, published Open Access in ‘Green Finance’ entitled: “Cost-benefit analysis in a climate of change: setting social discount rates in the case of Ireland” demonstrates that the Irish discount rate has been too high, resulting from applying an excessive assumption of future economic growth in the calculation, that is not plausible. The resulting national discount rate for Ireland is not credible, and needs to be reduced to 1.7 to 2.8%.

Seperately, a dual discount rate, for ‘goods’ that cannot be replaced -such as many environmental impacts and damage to human health- is estimated at ≤1.3 per cent. If Irish appraisal continues to lump all ‘goods’ under the same discount rate then a lower rate from this range is required. If dual discounting is applied, the 1.3% is necessary for impacts on the environment and human health, with a higher rate for other goods such as financial capital.

The article appears to be the first peer-reviewed journal publication on social discount rates in Ireland. Four independent lines of evidence support the conclusions in this article. This provides a very strong basis to make the necessary changes to Irish appraisal.

Source: O’Mahony (2021) https://www.aimspress.com/article/doi/10.3934/GF.2021010

Leave a comment